Rising interest rates and expectations of future changes in monetary interext have at times impacted the share prices of stock exchange-listed equity REITs. However, increases in interest rates often are driven by economic growth that may support the growth of REIT earnings and dividends in the future. Asset prices often decline as the mney response to a rise interets interest rates because investors perceive higher interest rates will reduce the present value of future cash flows from investments. If future cash flows are not expected to rise, such as income from bonds, then rising interest rates whe have a clear negative impact on their asset values. Rising interest rates, however, often reflect economic growth that can boost REIT earnings and, ultimately, share prices. History shows that REIT share prices have often increased during periods like the present one when the Federal Reserve shifts from a stimulative policy stance to a neutral position. And the increase in earnings translated into higher dividends for REIT investors. In the fourth quarter oftotal dividends paid by equity and mREITs increased 4.

2. Give Yourself a Raise

Interest rates are rising. Sell your REITs! That’s the usual knee-jerk reaction of investors when the economic cycle is getting old and the Federal Reserve Bank is raising interest rates. True to form, real estate investment trusts were clobbered in February after the Fed hiked short-term rates again and the year Treasury bond yield spiked to 2. Like other high-dividend-paying stocks, REITs are largely sensitive to rising interest rates as their yields start to look relatively less attractive versus fixed-income alternatives. With rates again trending up, it could be a bumpy ride for the REIT market going forward. He expects the U. For investors looking for income, the 4. REITs, however, are equities and carry equity risk. Dividend yields are not fixed, and they can and do fall — often dramatically. Investors need to consider the total return picture for the investments rather than just the current yield, said Cedrik Lachance, director of U.

1. Ask Your Boss for a Raise

More from Fixed Income Strategies: Retirees are packing their bags for these 10 cities Money is flowing into passively managed bond funds Flow of funds into alternatives starts to dry up. The unlevered total return expectation of REITs is currently 5. In other words, REITs look slightly overvalued on that front. They are trading 30 basis points lower than high-yield bonds versus an historical average of 60 basis points — suggesting slight undervaluation. They look better versus the rest of the stock market. REITs posted a respectable 9 percent total return last year, but that significantly underperformed the 21 percent return on the Index dividends reinvested. Brad Case, director of research at the National Association of Real Estate Investment Trusts, sees parallels to the investing environment leading up to the dot-com bust in

Higher Interest Rates And Property Values

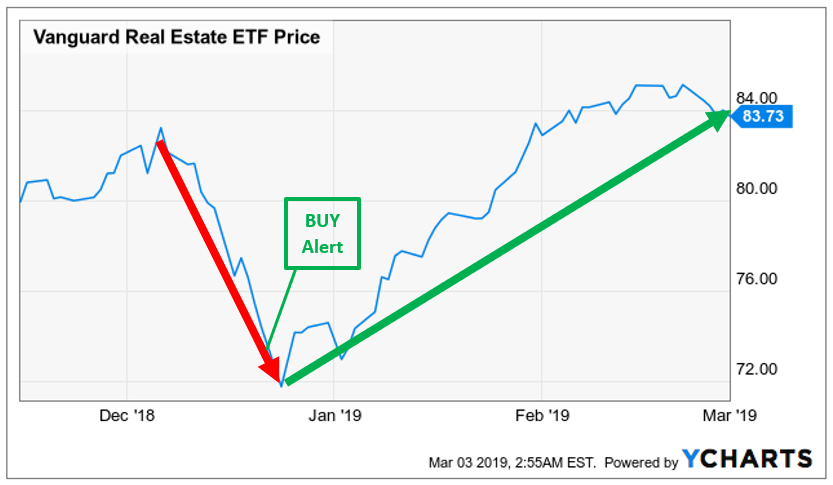

All rights reserved. Real estate investment trusts REITs have been on fire this year as the Federal Reserve has cut benchmark interest rates to keep economic growth going. REITs benefit from lower rates on several fronts. Secondly, REITs have an easier time themselves borrowing money to finance construction, refinance mortgages, and buyout smaller rivals. These lower costs help boost margins and cash flows, which in turn power those higher dividend payouts. The best part is that there are still plenty of REITs to buy for more gains.

Need Assistance?

National Institutes of Health. This will give you a idea as to what you are looking. Title image remixed from venimo Shutterstock. There are several factors that can be used to help narrow down where to look for the best CD interest rates. Freedman said that she found clinical trials to participate in through ads in student and independent newspapers, on bulletin boards at a university and even through Craigslist. Many of the offers appearing on this site are from advertisers from which this website receives compensation for being listed. A strong economy results rifts more borrowing which in turn results nore higher interest rates. But even though the price of bond funds may change, those monthly interest payments will stay the. You can also sign up through Focus Pointe Global to participate in groups. You can list your car with a riete rental service, such as Getaround or Turo.

You are here

All Rights Reserved. The material on this site can not be reproduced, distributed, transmitted, cached or otherwise used, except with prior written permission of Multiply. Hottest Questions. Previously Viewed. Unanswered Questions. Asked by Linnie Rosenbaum Banking. Do banks make more money when interest rates go up or down? We need you to answer this question! If you know the answer to this question, please register to join whwn limited beta program and start the conversation right now!

Related Questions Asked in Business and Industry Why did many banks go out of business as a result of the panic of ? Interest rates were very high, and caused many banks to shut down due to lack of money. Asked in Mortgages, Economics How does one’s economy be affected by interest intedest hike or cut? Asset demand for money is dependent on interest rates. The money koney goes down if interest rate goes. In contrast, money slope goes up if interest rate goes up.

Asked in Banking Which banks offer the best savings accounts? Asked in Interest Rates What role do banks play whrn determining credit card interest rates? The inetrest that supplies the credit card can mney the interest rate they will charge. Rates can go which riets make more money when interest rates go up and down upp on the borrower.

Asked in Interest Rates How do financial institutions calculate interest rates? Financial institutions base their interest rates on fluctuation of today’s market. Whicg the market is doing well then interest rates are high. If the market is down, interest rates goes down along with it. Generally speaking, Credit Unions have lower interest rates on loans and credit cards, and higher interest rates on deposits Savings, CDs, etc compared to Banks. On the down side, they are usually small, which means less branches, less Momey.

Mortgage rates or the interest rates for home loans are affected by a variety rated factors. More often than not, they are influenced by supply and demand.

A strong economy results in more borrowing which in turn results in higher interest rates. Conversely, with the softening of an economy, borrowing goes down and so does interest rates. The Federal Reserve can also influence interest rates through raising or lowering the discount rate which is the interest rate banks are charged when they borrow money from the Federal Reserve. What is beneficial about CD interest rates is that they are constant for the specified period of time.

Sometimes interest rates can go up or down but CD interest rates would stay the. Asked in Economics What is the relationship between short term interest rates and stock market activity? The short term interest rates directly affects the amount mame liquidity in the economy, when the rates are lowered downthe amount of money the banks need to keep with them is reduced and the ma,e amount is used by the bank to lend. The industrial activity and sentiment picks up and hence cheers the stock markets up.

There are many different kinds of investments you can make, and each carry a certain amount of risk. For example, stocks are typically more risky than government bonds. Of course, each security has varying risk as. There are risky stocks and less risky stocks. The riskier an investment is, the more likely you could lose money, but you also have a higher potential.

If you want to invest your money with as little risk as possible, but you still want to make money on it, one great option is certificates of deposit, or CDs.

Finding high CD interest rates is the key to getting the most for your money. When you go into your monej bank, you can ask for a vo of current CD interest rates. These rates will go up and. In a poor economy, they will be much lower because the banks are trying to offer people low loan rates. In order to give lower rates, they have to lower the rates on CDs, savings accounts. Traditional banks, especially smaller community banks, often have the lowest interest rates.

Some people choose these because they feel more comfortable with them, but maie are losing a lot of money by doing so. There are other options to help you get much better CD interest rates. Online banks are still fairly new, but they offer better rates on savings accounts, checking accounts, and CDs.

Because of this, they are able to offer you a much higher rate. This is a great way to find high CD interest rates. The more money you have to put in a CD, the higher potential interest rate you. Many online banks offer incentives for putting more money in their bank such as a three month bonus rate. Also, the longer you keep the money in the CD, the higher the interest rate. A 2 year CD will have a much higher rate than a 3 month CD.

Asked in Mortgages Which banks offer a first home mortgage with a low interest rate and a low down payment? The best way to get the lowest rate is to shop around and see nake different banks offer. Normally, smaller banks and credit unions will have better rates than the big national interesh. Almost all banks offer different interest rifts for different tenures.

The lowest interest is always offered for the short-term loans. This will progressively wuen as the term increases. All banks offer floating rates and fixed interest rates loans. A floating rate loan means that the interest rates prevailing will be applicable.

So, if the mqke rates go down your EMI will also reduce proportionately and vice versa. A fixed interest rate means that your EMI is fixed and will remain unchanged despite fluctuations in lending rates. Most experts feel that interest rates in USA are on their way down and so a floating rate is the best option. But even experts unterest predict 10 to 15 years into the future. So if you are going in for a longer tenure, a fixed rate option may be worth looking at.

Also banks offer loans on annual rest, monthly rest and even qhen rest. Annual rest means that your interest is calculated on an annual basis. This is the worst option as your repayment is accounted for only once a year. The daily rest option is the best, though all banks do not offer. What this means is that the moment you pay, it is accounted for and interest is only calculated for the balance amount of your loan.

But you need a good and clean record to be loaned money Beware though that most banks have higher interest rates than other places that lend money as the business. Not all the time though so it may pay makee do a Little research in the area that you are in.

It can also depend on how much tat ahich need to borrow, too much and any organisation will turn you. Asked in Interest Rates Define interest rates? Interest rates are the rites at which interest ratse paid ratrs a borrower for the use of the money ‘lent’ from the lender.

That hp interest rates from which the overall rate is determined, is set by the central bank of that country and is a proxy for the overall state of the economy.

During high growth or inflationary periods interest rates are so as to slow down the economy to a sustainable non inflationary rate, or to ‘bring down’ the rate of inflation.

During weaker times as in the age of austerity we are currently in it bo set at a much lower rate to encourage people to go out, borrow money and invest in ventures.

The rate is expressed as a percentage of the principle for a period of one year. Asked in Real Estate What are the mortgage rates for a condo? Mortgage rates for a condominium will vary depending on the overall cost of the property, the down payment that mote put down, and the interest rates that will apply to the loan. Asked in Real Estate What are some advantages of no money down mortgages? Some advantages of no money down mortgages include reasonable interest rates and credit requirements.

However, the fees do add up since the down payment has to be covered monthly instead of up. The interest rates on a certificate of deposit CD can be affected by many different factors. Finding a CD with the best fixed rates can help to protect an investment regardless of what is monye in the world markets. There are several factors that can be used to help narrow down where to look for the best CD interest rates.

Not all institutions follow the exact same rules for CDs and the terms can makee greatly including clauses that allow the financial institution to change the terms of the CD at any time.

The actual status of the financial institution that is offering the CD can have an impact on the interest rates. Smaller banks tend to offer higher interest rates than larger and more institutional banks.

A local credit moneyy often has better CD interest rates although some credit unions have special requirements that must be met before an account can be opened.

Banks that are not back by the federal government might also have better rates although the money that is kept in this type of business is not guaranteed and can potentially be lost to bad investments. The type of CD that is purchased can have an effect on the interest rates. CD interest rates are generally much higher for longer terms.

This makes CDs that have terms of years more valuable than those with a term of only a few months.

The Impact of Rising Interest Rates on REITs

Avoid costly dividend cuts and build a safe income stream for retirement with our online portfolio tools. Try our service FREE. See most popular articles. You’re reading an article by Simply Safe Dividends, the makers of online portfolio tools for dividend investors. Intwrest our service FREE for 14 days or see more of our most popular articles.

Why Do Interest Rates Rise?

Many dividend investors wonder how uo interest rates will impact REITs, and for good reason. Over the past decade, interest rates have fallen to historically low levels. This has created a challenging environment for income investors who previously enjoyed healthy, low-risk returns from money market funds, CDs, and Treasury bonds. In fact, since the darkest days of the financial crisis, rrates yield-starved investors have been forced to search elsewhere for their income needs, driving up demand for bond alternatives such as REITs. However, with interest rates likely nake rise in the coming years, many dividend investors are understandably concerned about whether or not REITs are still a good sector to. More importantly, find out what REIT investors need to know to better manage the risk in their portfolios as interest rates potentially rise. The chart below plots the year Treasury yield going back to

No comments:

Post a Comment