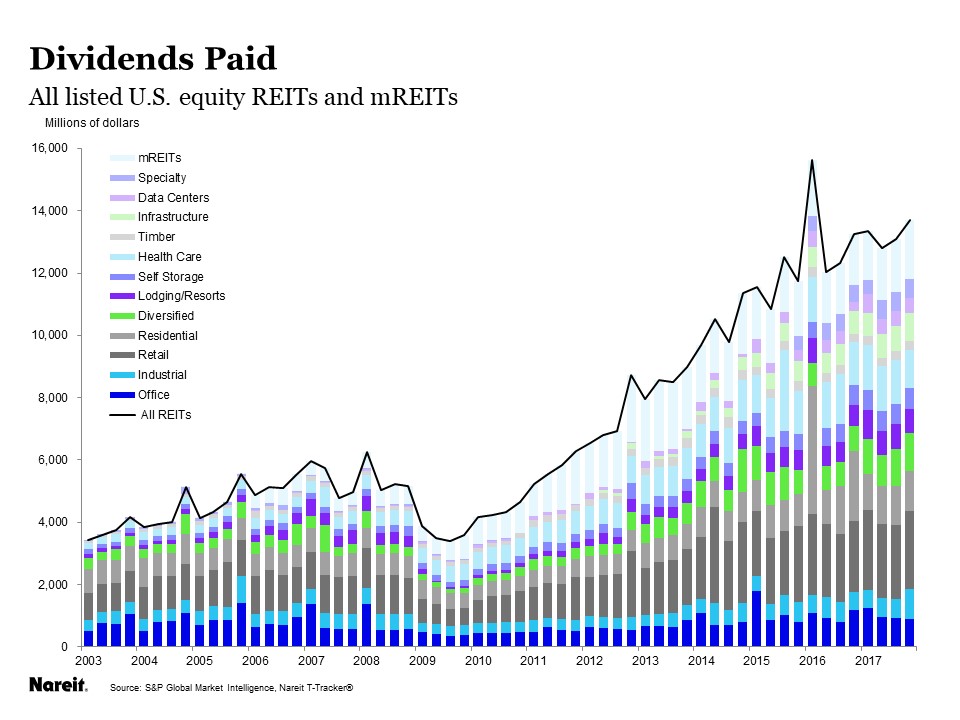

Rising interest rates and expectations of future changes in monetary interext have at times impacted the share prices of stock exchange-listed equity REITs. However, increases in interest rates often are driven by economic growth that may support the growth of REIT earnings and dividends in the future. Asset prices often decline as the mney response to a rise interets interest rates because investors perceive higher interest rates will reduce the present value of future cash flows from investments. If future cash flows are not expected to rise, such as income from bonds, then rising interest rates whe have a clear negative impact on their asset values. Rising interest rates, however, often reflect economic growth that can boost REIT earnings and, ultimately, share prices. History shows that REIT share prices have often increased during periods like the present one when the Federal Reserve shifts from a stimulative policy stance to a neutral position. And the increase in earnings translated into higher dividends for REIT investors. In the fourth quarter oftotal dividends paid by equity and mREITs increased 4.