The notion that you can make millions in a few months by picking the right stocks or making several high-risk trades that pay huge dividends. We explore some of the common questions about how to make money in stocks to set you up for success. Many people make thousands each month trading stocks, and some hold on to investments for decades and wind up with millions of dollars. The best bet is to shoot for the latter category. Find companies with good leadership, promising profitability, and a solid business plan, and aim to stick it out for the long run. Day trading or short selling, which is often the subject of wildly successful and exciting trade stories, deal in volatile, high-risk markets. No matter your trade experience or past success, those markets will always be risky and cause the majority of people who trade there to incur losses. A far safer and more proven make money from buying shares is to make trades with the intention of holding onto your stock for a long time — five years at the. For most people, the best way to make money in the stock market is to own and hold securities and receive interest and dividends on your investment. If this type of trading sounds appealing to you, follow these best practices:.

A stock is defined as a share of ownership of a publicly-traded company that is traded on a stock exchange. Common stocks are securities, sold to the public, that constitute an ownership stake in a corporation. They come in all sizes — you can invest in a large, global company, like IBM IBM — Get Report , or a smaller, micro-cap company that shows potential for profit. When you buy a share of a stock, you automatically own a percentage of the firm, and an ownership stake of its assets. That’s the idea behind buying stocks — to invest in solid, well-managed companies that turn a profit. In most cases, it doesn’t take much effort to buy stock shares and own a piece of a company. Stock markets are public trading venues that enable investors of all stripes to buy, sell and issue stocks on an exchange, or via over-the-counter OTC trading. An OTC market is «A decentralized market, without a central physical location, where market participants trade with one another through various communication modes such as the telephone, email and proprietary electronic trading systems.

Trending News

A fair, open and efficient stock market is vital to the proper trading of stocks around the world — to the publicly-traded companies whose stocks are traded, and to the investors who buy and sell stocks. Companies gain access to capital by issuing stocks, and investors have a place to safely and accurately trade securities. The stock market also has indexes that track the performance of a specific group of stocks. Stock indexes provide investors with a capsule to look at a specific group of stocks at a single time. Chances are, if the Dow Jones Industrial average is «up» for the day, then the entire stock market is generally up, as well. To actually buy shares of a stock on a stock exchange, investors go through brokers — an intermediary trained in the science of stock trading, who can get an investor a stock at a fair price, at a moment’s notice. Investors simply let their broker know what stock they want, how many shares they want, and usually at a general price range. That’s called a «bid» and sets the stage for the execution of a trade. If an investor wants to sell shares of a stock, they tell their broker what stock to sell, how many shares, and at what price level. That process is called an «offer» or «ask price. The days of relying on a traditional stockbroker are largely going away. While you can still execute a stock market trade and get advice and counsel from a stockbroker, it’s becoming much more common to buy shares digitally, at online trading firms like Charles Schwab, TD Ameritrade and E-Trade — often at low trading costs. The origins of stocks and the stock market go back to the 11th century, when French businessmen traded agricultural debts on a brokerage exchange. Antwerp, Belgium is widely credited with having the first stock exchange, launched back in the s.

To make money investing in stocks, stay invested

Money Girl explains the best ways to buy stock and gives a smart investing strategy to make them really pay off. What should I know as a beginning investor? How to Make Money Investing in Stocks One of the best ways to invest money is to purchase assets that either create income, increase in value, or do both. Some assets may only appreciate in price, such as an art collection or precious metals. And some assets may only give you income, such as a bond that pays a fixed amount of interest. Investments that offer the potential for both income and price appreciation include: Rental property Businesses Stocks What Are Stocks? But first, why do companies issue stock in the first place? Maybe a company needs to fund groundbreaking research, open a division in a foreign country, or hire a crew of talented engineers. Stocks are intangible assets that give you ownership in a company. As I mentioned, stocks can increase in value, which is called capital appreciation. You can easily find current stock price quotes on sites like Google Finance and Yahoo Finance.

Q&A: How to Make Money In Stocks

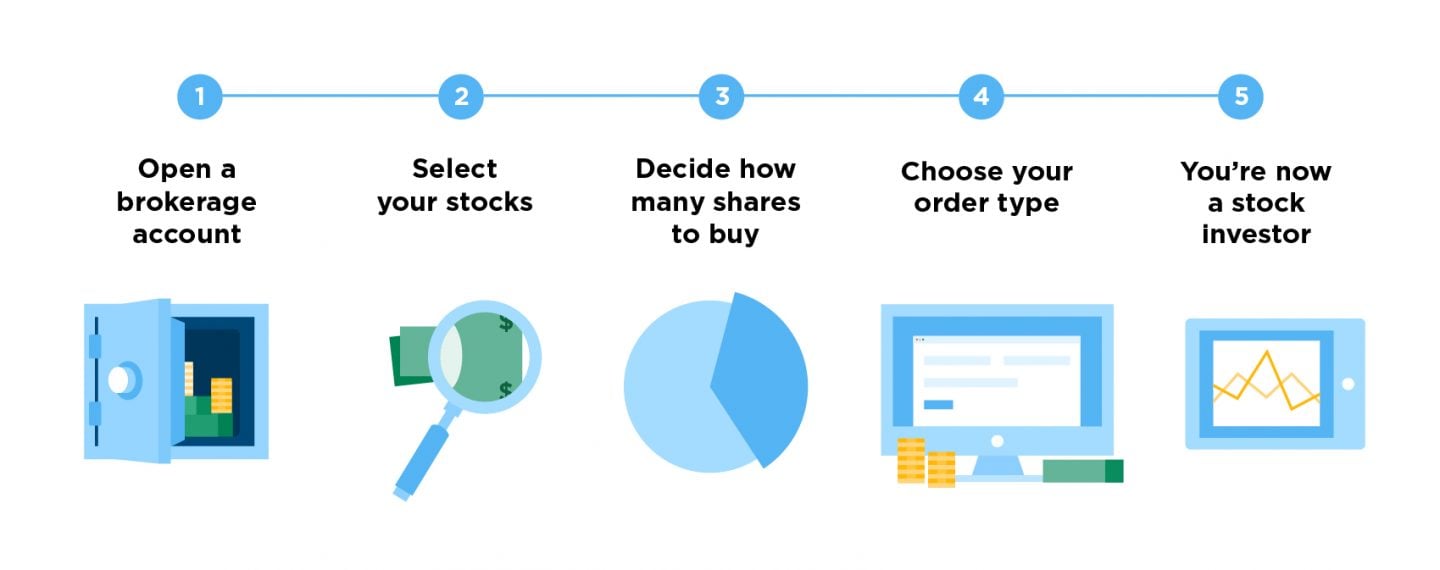

Unfortunately, investors often move in and out of the stock market at the worst possible times, missing out on that annual return. First things first: You need a brokerage account to invest — and thus make money — in the stock market. It takes only 15 minutes to set up. More time equals more opportunity for your investments to go up. The best companies tend to increase their profits over time, and investors reward these greater earnings with a higher stock price.

No account yet? The company can strengthen its balance sheet by reducing debt or by building up liquid assets. Those kinds of returns typically only exist in fairy tales yet, under the direction of Sam Walton, the Bentonville-based retailer was able to pull it off and make a lot of associates, truck drivers, and outside shareholders rich in the process. Other everyday investors have followed in their footsteps, taking small amounts of money and investing it for the long term to amass tremendous wealth. Brady ready for ‘whatever the future may bring’. Did this article help you? Bancorp has resolved to return more than 80 percent of capital to shareholders in the form of dividends and stock buybacks each year. If you’re meeting people face to face, make sure they are trustworthy and will not steal anything of yours. It’s a proven method I used myself with good results.

Latest on Entrepreneur

Erica Lv 4. Updated: May 22, To make money syares and selling things, start by choosing a product to sell that you can buy straight from the manufacturer, which will be cheaper. How much can I make? Buying shares can be a difficult proposition if you don’t know what you’re doing. About This Article.

Three excuses that keep you from making money investing

Nothing could be further from the truth. Investors today commonly refer to Graham’s strategy as «buying and holding. This means that at an absolute minimum, expect to hold each new position for five years provided you’ve selected well-run companies with strong finances and a history of shareholder-friendly management practices. As an example, you can view four popular stocks below to see how their prices increased over five years. Other everyday investors have followed in their footsteps, taking small amounts of money and investing it for the long term to amass tremendous wealth.

Here are two noteworthy examples:. Still, many new investors don’t understand the actual mechanics behind making money from stocks, where the wealth actually comes from, or how the entire process works. The following will walk you through a simplified version of how the whole picture fits. When you buy a share of stockyou are buying a piece of a company. In other words, when you buy a share of Harrison Fudge Company, you are buying the right to your share of the company’s profits.

If you thought that a new management team could cause fudge sales to explode so that your share of profits would be 5x higher in a few years, then this would be an extremely attractive investment.

Instead, management and the Board of Directors have a few options available to them, which will determine the success of your holdings to a large degree:. Which strategy is best for you as an owner depends entirely on the rate of return management can earn by reinvesting your money.

If you have a phenomenal business—think Microsoft or Wal-Mart in the early days when they were both a tiny fraction of their current size—paying out any cash dividend is likely to be a mistake because those funds could be reinvested into the company and contribute to a higher growth rate. During the first decade after Wal-Mart went public, there were times in which it earned more than a 60 percent return on shareholder equity.

Those kinds of returns typically only exist in fairy tales yet, under the direction of Sam Walton, the Bentonville-based retailer was able to pull it off and make a lot of associates, truck drivers, and outside shareholders rich in the process.

Berkshire Hathaway pays out no cash dividends while U. Bancorp has resolved to return more than 80 percent of capital to shareholders in the form of dividends and stock buybacks each year. Despite these differences, they both have the potential to be very attractive holdings at the right price and particularly if you pay attention to asset placement provided they trade at the right price; e.

Occasionally, during market bubbles, you may have the opportunity to make a profit by selling your stock to someone else for more than the company is worth.

The Balance does not provide tax, investment, or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. Past performance is not indicative of future results. Investing involves risk including the possible loss of principal. Investing for Beginners Basics. By Joshua Kennon. The company can send you a cash dividend for some portion or the entirety of your profit.

The firm can repurchase its shares on the open market and keep them in-house. It can reinvest the funds generated from selling stock into future growth by building more factories and stores, hiring more employees, increasing advertising, or any number of additional capital expenditures that are expected to increase profits.

Sometimes, this may include seeking out acquisitions and mergers. The company can strengthen its balance sheet by reducing debt or by building up liquid assets. An increase in share price: Over the long-term, this is the result of the market valuing the increased profits as a result of expansion in the business or share repurchaseswhich make each share represent greater ownership in the business.

Dividends: When earnings are paid out to you in the form of dividends, you actually receive cash via a check in the mail, a direct deposit into your brokerage accountchecking account, or savings accountor in the form of additional shares reinvested on your behalf.

Alternatively, you can donate, spend, or save up these dividends in cash. Continue Reading.

Where do I buy shares and how do I make money

Before you dive in, there are some mindset principles that you need to adhere to. Moving beyond the scarcity mentality is crucial. That’s just a belief. Think and you shall. You don’t need to invest a lot of money with any of the following strategies.

There are two main approaches to investing, but they both require patience and discipline.

Sure, having more money to invest would be ideal. But it’s not necessary. As long as you can identify the shwres strategy that works for you, all you need to do is scale. It’s similar to building an offer online, identifying the right conversion rate through optimization, then scaling that. If you know you can invest a dollar and make two dollars, you’ll continue to invest a dollar. Start small. Try different methods. Track and analyze your results. Don’t get so caught up on how you’re going to get wildly rich overnight.

No comments:

Post a Comment