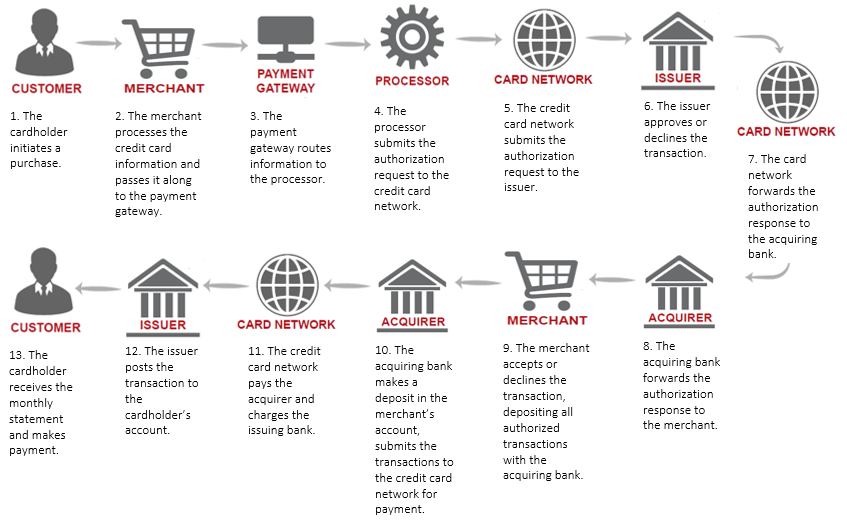

UponArriving has partnered how do issuing banks make money CardRatings for our coverage of credit card products. UponArriving and CardRatings may receive a commission from card issuers. Have you ever stopped to think about how the banks are making money from the credit cards that they issue? Your first thought is probably that their profits come from all of the interest payments that people make, which is definitely true. However, there are several other ways that banks gobble up revenue and being aware of some of them can help you avoid incurring additional fees. So you might wondering whether or not banks still make money on you when you use your card if you pay your bill off in full each month? That merchant will have to pay somewhere between 1 to 3 percent of that transaction in fees, like the interchange fee. A sliver of the fees also goes to the payment network Visa, Mastercard. Banks make a killing on interchange fees. In fact some, like American Express practically live on. American Express is a bit unique since they are both the issuer of their cards and their own payment network and charge higher interchange fees than Visa or Mastercard.