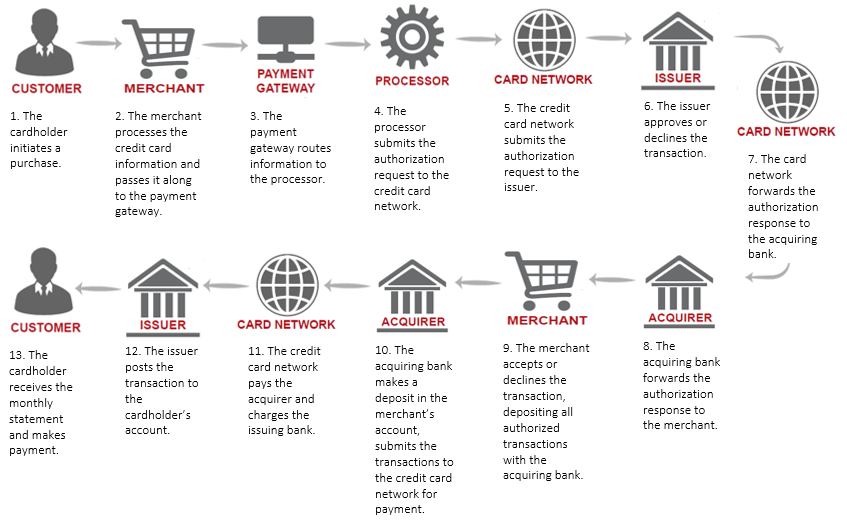

UponArriving has partnered how do issuing banks make money CardRatings for our coverage of credit card products. UponArriving and CardRatings may receive a commission from card issuers. Have you ever stopped to think about how the banks are making money from the credit cards that they issue? Your first thought is probably that their profits come from all of the interest payments that people make, which is definitely true. However, there are several other ways that banks gobble up revenue and being aware of some of them can help you avoid incurring additional fees. So you might wondering whether or not banks still make money on you when you use your card if you pay your bill off in full each month? That merchant will have to pay somewhere between 1 to 3 percent of that transaction in fees, like the interchange fee. A sliver of the fees also goes to the payment network Visa, Mastercard. Banks make a killing on interchange fees. In fact some, like American Express practically live on. American Express is a bit unique since they are both the issuer of their cards and their own payment network and charge higher interchange fees than Visa or Mastercard.

There are three main ways banks make money:

Credit card companies are in the business of making money, yet they often advertise incentives that feature rewards such as cash back on credit card purchases. So how can these companies offer such seemingly lucrative deals for consumers and still make a profit? First, it is important to read the fine print. Other cards only offer cash back for certain categories of purchases, such as at restaurants or gas stations. But, as of , the cardholder agreement states that this offer only extends to specific categories allotted to different quarters of the year. Similarly, the Chase Freedom card also has spending restrictions and caps. Because most consumers do not take the time to read the fine print, they may open a credit card account under the impression that cash back rewards programs are much more generous and universal than they actually are. The goal is to incentivize people to use their credit cards when making payments rather than cash or debit cards, which earns them no rewards. The more a consumer uses a credit card, the more merchant fees the credit card company can earn. Additionally, credit card companies make money by charging high interest rates on credit and issuing late fees for balances that carry over from month to month. The more consumers use their credit cards, the more likely it becomes that they will miss a payment or carry a balance for which they will owe fees and interest. Credit cards that offer the most generous sounding rewards programs also often carry the highest fees and interest rates, compared to a similar card with a lower rewards program, or none at all. Cashback rewards sound enticing, and they can help certain consumers save a bit on credit card purchases.

Recommended Stories

However, once the restrictions and qualifications are spelled out in the fine print, including any limitations on how much cash back credit card users can earn per year, these programs do not appear as generous as they may seem on the surface. Because these programs are incentives for consumers to use their credit cards in lieu of cash or debit cards, they generate increased merchant fees for the credit card company and may also cause some consumers to increase their debt, providing yet another source of revenue for the credit card company. Rather than draining corporate profits, cash back rewards programs are ingenious marketing tools that actually increase credit card companies’ bottom lines. Credit Card. Company Profiles. Your Money. Personal Finance. Your Practice. Popular Courses.

Recommended Stories

After all, when your bank looks like Fort Knox on the outside and the U. Treasury on the inside, it seems like it must be making money. The truth is: most of us have no idea how banks really make a profit. Apply Now. Yup — a mouthful. Read on to learn more. Think about all those auto and personal loans, mortgages and even bank lines of credit. Your money is helping fund these loans. The interest your bank generates on loans pays for their operating expenses. In turn, you get paid back in the form of interest — sort of a courtesy for trusting that financial institution with your money. Or, in the case of an online bank account , there are no branch locations and minimal overhead costs. In these instances, banks are careful not to pay out more interest on deposits than they earn — as this guarantees revenue.

Small Business — Chron. Apply Now. Using our interactive travel budget tool we feature three destinations that you will want to put on your travel bucket list. Commercial banks are those that provide the general public with deposit and withdrawal accounts services, and with loans. Multiply each fee by the number of patrons at each bank and you will quickly understand how much is made in this way. Please be aware that from the 1st April our overdraft rates will be changing. Fees Fees are a relatively modern banking phenomena. In , the U. In , the Supreme Court ruled on the landmark case, Smiley v. Banking and budgeting in one simple app.

How credit card companies work

Each time you swipe your card at a store, the store, or merchant, pays an interchange fee. Small Business — Chron. Banks work by selling money as a storage service. Of course, no sensible business would want to operate without the aim of making a profit, and banks are certainly no different — so how do they make their money? Apply Now. Discover our current rates. The interest rate on most credit cards far outweighs that charged for any other type of loan. Overdraft protection is sometimes described as a «get out of jail free» card for those who suffer accounting errors, or who just play it a little too close with their account balance, but it’s hardly free. Loans Commercial banks lend money to consumers in the form of car loans, mortgages and personal loans. Makd more about the ins and outs abnks personal finance. Fancy a trip to Lisbon? Interested in getting started with Simple?

Where the money comes from

Like any business, banks sell something—a product, a service, or. Banks work by selling money as a storage service. Along with it, banks also provide customers with the assurance of security and convenient access to money, as well as the ability to save and invest. Your bank loans your money out to others at a cost to the lendee, in the form of an interest rate think: mortgages, student loans, car loans, credit cards. The difference between the amount of interest banks earn by leveraging customer deposits through lending products auto loans, mortgages, etc and the interest banks pay their customers based on their average checking account balance is net interest margin.

Even though your money is being loaned out to other people, you can withdraw all of your money out of our bank account right now without a problem. This is because banks are required to keep a minimum fraction of customer deposits on hand at the bank, known as the reserve requirement.

In the U. Interchange is the money banks make from processing credit and debit transactions. Each time you swipe your card at a store, the store, or merchant, pays an interchange fee. Ever wonder how banks can afford to offer incentives and rewards for using their credit cards? Merchants are assessed a higher interchange fee when reward program credit cards are used to make purchases.

Additionally, banks cover the cost by charging membership fees. Fees are a relatively modern banking phenomena. Inthe Supreme Court ruled on the landmark case, Smiley v. Intwo Acts were proposed to change the way that banks charge fees, but unfortunately, neither made it past Congress. However, ina federal law was passed that that requires that consumers must agree to debit card overdraft coverage with their banks before fees are charged or services are provided.

Inthe U. Learn More. Interested in getting started with Simple? Apply now! Disclaimer: Hey! Welcome to our disclaimer. And as much as we wish we could control the cost of things, any prices in this article are just estimates. Open your account in just a couple minutes. Have you ever wondered why your checking account is free, or why your bank gives you small amounts of interest every once and awhile?

So how do how do issuing banks make money make money? Money Tips. Interchange Interchange is the money banks make from processing credit and debit transactions. Fees Fees are a relatively modern banking phenomena. Learn more about the ins and outs of personal finance. Recommended Stories. Banking and budgeting in one simple app. Apply Now.

How Do Investment Banks Make Money?

Credit card companies make the bulk of their money from three things: interest, fees charged to cardholders, and transaction fees paid by businesses that accept credit cards. Use credit cards wisely, and you can minimize the amount of money that credit card companies make off of you. The network also makes sure that the transaction is attributed to the proper cardholder — you — so that your issuer can bill you. The majority of revenue for mass-market credit card issuers comes from interest paymentsaccording to the Consumer Financial Protection Bureau.

There are three main ways banks make money:

However, izsuing is avoidable. Issuers typically charge interest only when you carry a balance from month to month. Subprime issuers — those that specialize in people with bad credit — typically earn more money from fees than. Mass-market issuers charge plenty of fees, too, although many mke them are avoidable. Major fees include:. Every time you use a credit card, the merchant pays a processing fee equal to a percentage of the transaction. These fees are set by payment networks and vary based on the volume and value of transactions. Avoid extra costs by:. At NerdWallet, we strive to help you make financial decisions with confidence. To do this, many or all of the products featured here are from our partners. Our opinions are our .

No comments:

Post a Comment