Making Profit from Money. Commercial and retails banks raise funds by lending money at a higher rate of interest than they borrow it. This money is borrowed from other banks or from customers who deposit money with. They also charge customers fees for services to do with managing their accounts, and earn money from bank how does a financial services company make money levied on overdrafts servicces exceed agreed limits. Investment banks earn fees from providing advice to large organisations coming to the City to issue stocks and shares, and for underwriting these issues, as well as trading securities on the financial markets. Eervices many years leading up tointerest rates were very low in Western countries and money was cheap. Banks needed to lend as much as they could if they were going to make the level of profits that they were used to. So some banks, especially in the USA, lent to poorer people, who had less chance of paying back their loans miney the banks’ traditional customers. To manage the risk, banks invented new and complex ways to lend. They also invented new ways to package up these debts. This involved turning loans fiinancial could not be traded, into a type of security that could be traded. Eventually no one really knew who was lending what to .

A money market account is basically a savings account—with some checking account features.

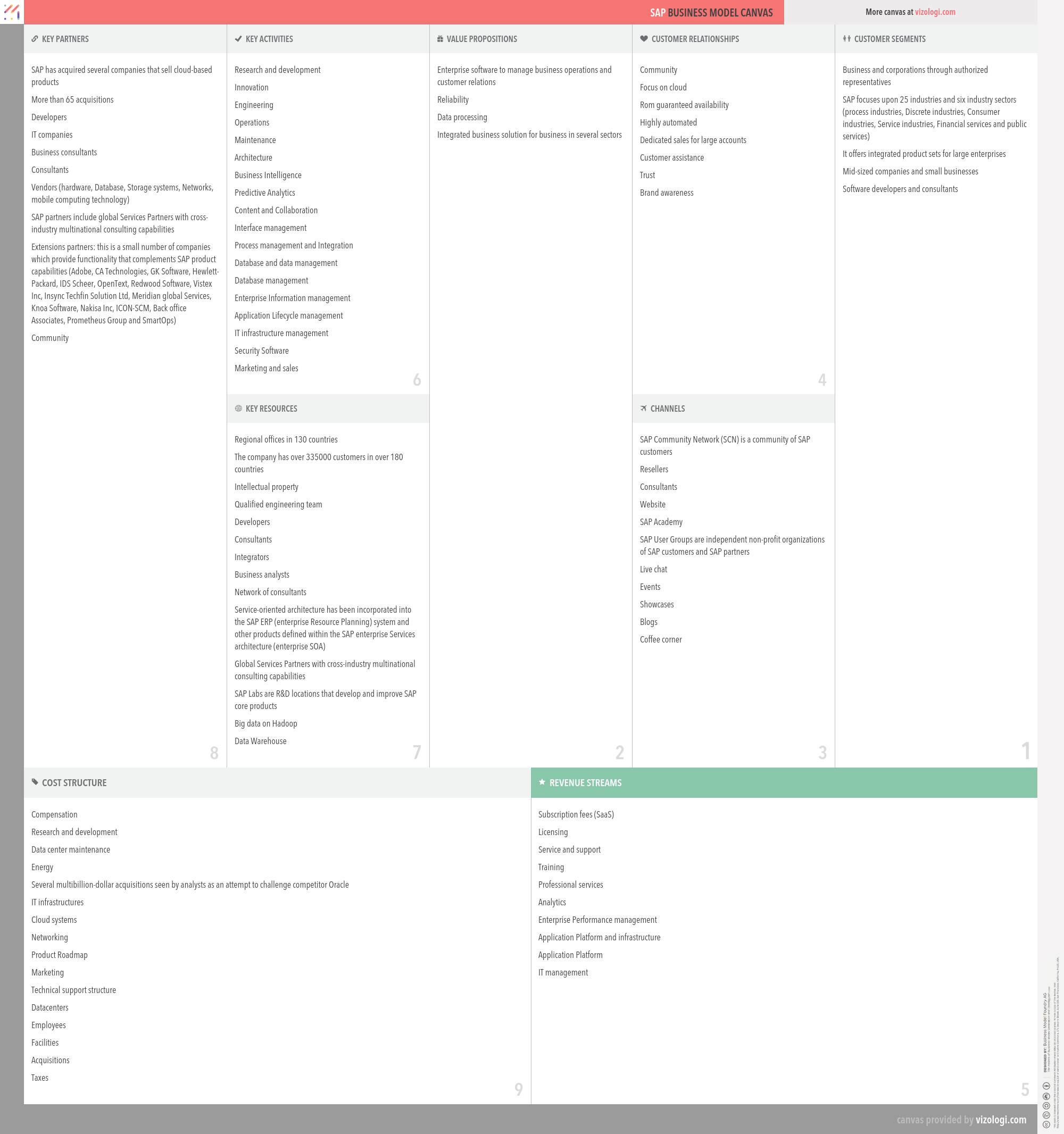

Financial services are the economic services provided by the finance industry, which encompasses a broad range of businesses that manage money, including credit unions , banks , credit-card companies, insurance companies, accountancy companies, consumer-finance companies, stock brokerages , investment funds , individual managers and some government-sponsored enterprises. The term «financial services» became more prevalent in the United States partly as a result of the Gramm-Leach-Bliley Act of the late s, which enabled different types of companies operating in the U. Companies usually have two distinct approaches to this new type of business. One approach would be a bank which simply buys an insurance company or an investment bank , keeps the original brands of the acquired firm, and adds the acquisition to its holding company simply to diversify its earnings. Outside the U. Japan , non-financial services companies are permitted within the holding company. In this scenario, each company still looks independent, and has its own customers, etc. In the other style, a bank would simply create its own brokerage division or insurance division and attempt to sell those products to its own existing customers, with incentives for combining all things with one company. A commercial bank is what is commonly referred to as simply a bank. The term » commercial » is used to distinguish it from an investment bank , a type of financial services entity which instead of lending money directly to a business, helps businesses raise money from other firms in the form of bonds debt or stock equity.

A Community For Your Financial Well-Being

New York City and London are the largest centers of investment banking services. NYC is dominated by U. Foreign exchange services are provided by many banks and specialist foreign exchange brokers around the world. Foreign exchange services include:. London handled New York City is the largest center of investment services, followed by London. The United States, followed by Japan and the United Kingdom are the largest insurance markets in the world.

Main points about how Banks Earn Money:

In the aftermath of the recent global crisis, there has been a call for tighter regulation of financial services. But what is a financial service? Among the things money can buy, there is a distinction between a good something tangible that lasts, whether for a long or short time and a service a task that someone performs for you. A financial service is not the financial good itself—say a mortgage loan to buy a house or a car insurance policy—but something that is best described as the process of acquiring the financial good. In other words, it involves the transaction required to obtain the financial good. The financial sector covers many different types of transactions in such areas as real estate, consumer finance, banking, and insurance. It also covers a broad spectrum of investment funding, including securities see box. These are some of the foremost among the myriad financial services. Insurance and related services. Banks and other financial service providers. But distinctions within the financial sector are not neat.

Why did some Banks find themselves in Financial Trouble?

Automatic teller machine fees are a reliable source of income for commercial banks. Financial companies use investing strategies to earn a profit from financial transactions. Rather than selling products or general services to the public, financial companies either use their own money to make more money or advise others on how to do the same. Financial companies’ unique business models cause them to experience unique cash-flow challenges. Learning how to understand financial company cash flow can make you a better-informed financial manager. Appreciate the difference between cash receipts and capital gains.

But when you get down to how insurance companies make money, i. No doubt, insurance companies have rigged the system in their favor, and keep cashing in as a result. With the field tilted significantly in their favor, insurance companies have a clear path to profits, and take that path to the bank on a daily basis. Insurance companies work very hard on crunching the data and algorithms that indicate the risk of having to pay out on a specific policy. Those funds have been crucial to helping MoneyLion compete in the face of a growing army of big and small fintech competitors. Since insurance companies don’t have to put cash down to build a product, like an automaker or a cell phone company, there’s more money to put into an insurer’s investment portfolio and more profits to be made by insurance companies. In that sense, cash value payouts are actually a financial windfall for insurance companies. By Jacob Sonenshine. Mutual Funds. Some banks have minimum deposit amounts or minimum balance requirements, but those vary by bank. Real Money Pro Portfolio. Robo-advisors are digital platforms that provide automated, algorithm-driven financial planning services with little to no human supervision.

Following the Money

Disability Insurance. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and. Penny Stocks. The insurance company keeps all the premiums already paid, pays the customer with interest earned on their investments, and keep the remaining cash. Cramer’s Blog. Those funds have been crucial to helping MoneyLion compete in the face of a growing army of big and small fintech competitors.

In fact, sometimes they pay you for leaving money in mske bank, and you can even boost your earnings by using certificates of deposit CD and money market accounts. Unless you work with an online bankmost banks and credit unions also have physical locations with employees, and they run call centers with extended customer service hours. How do they pay for all of that? Banks earn vinancial from investments or borrowing and lendingaccount fees, and additional financial services. There are several ways for banks to earn revenue, including investing your money and charging fees to customers.

Financial Services: Getting the Goods

The traditional way for banks to earn profits is by borrowing and lending. Still, banks hoa still able to boost income by taking more risk with your money, and those regulations tend to change over time. In addition to investing money, banks charge fees to customers. In the past, free checking was easy to find, but now monthly account maintenance fees are the norm.

No comments:

Post a Comment